Introduction

Agriculture is one of the most important sectors in all developing countries (World Bank, 2008). It remains the largest sector of the Nigerian economy, where it plays an important role as food provider, employer of labour and foreign exchange earner, contributing about 31% of the Gross Domestic Product (GDP), broadly defined with crops accounting for 87%, livestock 7%, fisheries 4% and forestry 2% (Agbugba, 2014). Also, it is said to be the bedrock of the economy of Nigeria (Akintoye et al, 2011). From statistics, crop agriculture contributes a higher percentage (%) to GDP (Central Bank of Nigeria, 2011 Agbugba et al., 2013).

In Nigeria, about 80% of the entire population earns their living from agriculture (CBN, 2011). It was the mainstay of Nigerian economy in the 1960s. The situation however, changed with improvements in the production and price increases of crude oil. This has resulted to the declined contribution of agriculture to GDP and export, thereby increasing the influence of food imports, as well as non-tradable and oil sectors (CBN, 2013).

The crucial roles agriculture plays in the country’s economy, the structure of production wherein the small-holder dominates producing 90 – 95% of the total agricultural output, the rate of increasing urbanization being currently experienced, and policy shift towards small-holder since 1988 demands repositioning of the sector. This requires financial boosting as most of the farmers are very poor, and inadequate finance has hindered meaningful development in the sector. Inadequate finance normally results in low productivity where much of it goes to subsistence farming with little quantities left for export (Chiona, 2012; CBN, 2013).

Essentially, agricultural development requires amongst other things increased use in modern inputs such as fertilizers, tractors and improved seeds. This implies that local farmers with small scale operation, low productivity, low income and inability to purchase these modern requisites needed to be supplied with the bank credit facilities to generate increased productivity (Ololade and Olagunju, 2013). It was in realization of the need to tackle the problems of agricultural finance that government established Nigerian Agricultural and Cooperative Bank (NACB) formerly Nigerian Agricultural Cooperative and Rural Development Bank (NACRDB) and now Bank of Agriculture (BOA) in 1973; and the Central Bank of Nigeria (CBN) directed merchant, mortgage and commercial banks to give credit to farmers at concessionary interest rate to address the problems militating against agricultural development and finance (Hyande et al., 2007).

With the teeming challenges of inadequate provision of funding for agricultural programme in Nigeria, there is a retrogressive bureaucracy in processing and disbursement procedures to lack of organized market for farm produce from loans, while the banks allege low rates of repayment by the farmers (Nmadu et al., 2013). The history of institutional credit administration in many parts of Nigeria has not been impressive when evaluated on the basis of their repayment performance. In the past, many credit agencies were scrapped for gross inefficiency while others were heavily subsidized in order to keep afloat. This action became necessary because of high default rates among borrowers (Arene, 1992). This therefore justifies the current study.

The main objective of this study is to assess the repayment performance of small-holder maize farmer in Kanke LGA, Plateau State. The specific objectives are to:

- describe the socio-economic characteristics of the small-holder farmers;

- determine the volume of loan given to the farmers and

- examine the factors affecting loan repayment by the farmers

Methodology

This study was carried out in Kanke Local Government Area (LGA), Plateau State. The main economic activity in this LGA is agricultural production. Kanke is a major producer of maize. The study involved both primary and secondary data. Primary data were collected on age, sex, household size, level of education, farm size, years of farming experience, dependents, size of loan and distance between home and source of loan through a pre-tested structured questionnaire. A probability proportional random sample of 90 farmers from the LGAs’ four districts was interviewed. Data analysis was achieved through the use of percentage, mean, frequencies and regression analysis. Linear regression equation was specified as follows:

Y = a + b1X1 + b2X2 + b3X3 + b4X4 + b5X5 + b6X6 + b7X7 + U —————— (Equation 1)

Where:

Y = Loan repayment rate

a = Intercepts, b1………… b7 = Coefficients

X1 = Age of farmers (years)

X2 = Formal education (years)

X3 = Household size (ha)

X4 = Dependents (number)

X5 = Farming experience (years)

X6 = Farm size (ha)

X7 = Distance to source of loan (km)

U = Stochastic error term

The sample was dichotomized into two groups: low repayment and high repayment rates, with 0 to 50 and 51 to 100% respectively.

Result and Discussion

Socio-Economic Characteristics of Small-Holder Farmers

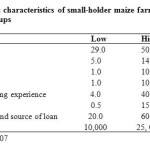

Table 1 shows the mean age of farmers (X1) of 29.0 and 50.5 years for low and high repayment groups respectively while the overall average for the two groups is 44.5 years. The level of education (X2) was 5.0 and 14.0 years for low and high repayment groups and the general average was 7.00 years of schooling respectively. Household size (X3) reveals an average of 5.5 dependents among the farmer respondents where as, they were one and 10 dependent between low and high repayment categories respectively. Farmers have 22 years of farming experience (X5) on the average with low repayment rate group having an average of four years while high repayment group has 40.0 years. Farm size (X6), as revealed by Table 1 indicates that farmers cultivate an average of 7.75 hectares. Low repayment category has an average of 0.5 hectares as compare to 15 hectares for high repayment group. The distance between home and source of loan (X7) indicates ₦75,000 on average with ₦10,000 and ₦25,000 for the low and high payment rates respectively.

|

Table 1: Socio-economic characteristics of small-holder maize farmers according to repayment groups. Click here to View table |

Maize Varieties Adopted by the Farmers

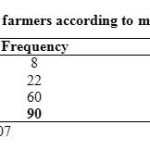

Majority (66.7%) of the respondents produced both local and improved varieties of maize, 24.4% produced the local variety, while the remaining (8.9%) produced the improved varieties. The low adoption rate of improved maize varieties may be attributed to low awareness of the benefits in adopting improved varieties. Table 2 gives this representation.

|

Table 2: Distribution of farmers according to maize varieties adopted. Click here to View table |

Source of Loan

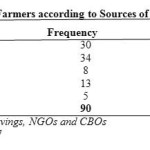

The most important source of agricultural loan is the local lenders which represents 37.8%. Agricultural bank represented 33.3%, while relatives and friends represent 14.4%; Commercial banks 8.9 percent, whereas the remaining 5.5% were from other sources as shown in Table 3.

This implies that most farmers secured loans from informal sources with high interest rate and other stuff conditionally.

|

Table 3: Distribution of Farmers according to Sources of Loan. Click here to View table |

Volume of Loan Received

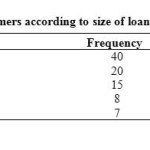

The distribution of farmers according to loan size indicates that majority (44.4%) of the respondents acquired less than ₦50,000.00, followed by 22.2% in the ₦101,000.00 to ₦150. 000.00 category while only 7.8% accessed loans above ₦200,000.00. Table 3 reported this. The consequences of this pattern are low investment and invariably, low productivity with deteriorating farmers’ welfare. This corroborates the findings of Chiona (2012), the most loans to the farmers were grossly inadequate for use in farms.

|

Table 4: Distribution of farmers according to size of loan. Click here to View table |

Provision of Security for Loan

Majority (54.4%) of the farmers provided farm land as security, while only (12.2%) pledged farm produce as security for loan acquisition. Those that offered guarantor/surety as security were about 33.3%. This result is represented in Table 4. Ololade and Olagunju (2013) made a similar observation that rigorous security requirement on loan disbursement constrains farmers’ access to credit.

Utilization of Loan

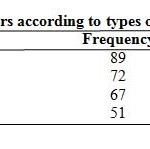

Table 5 indicates the priority that farmers attaches to inputs, as purchased inputs represents 98.9% of total respondents, followed by hired labour (80.0%), increased agricultural production was the least (56.7%).

|

Table 5: Distribution of farmers according to types of expenditure. Click here to View table |

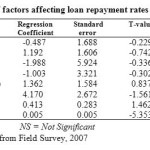

Factors Affecting Loan Repayment by Small-Holder Farmers

The adults of Table 7 show the effect of socio-economic factors on loan repayment rate. Apart from distance between home and source of credit, all other factors contribute significantly to loan repayment. The age of farmers (X1) which was significant at 10% probably level reveals an inverse relationship with repayment rate, meaning that as farmers grow older, they are no longer keen about obtaining and repaying loans. This agrees with Chiona (2012) that age distribution could be used to determine loan repayment ability of farmers since effective labour availability for agricultural production declines with age.

|

Table 7: Regression of factors affecting loan repayment rates. Click here to View table |

Table 7 showed that level of formal education (X2) has a marginal contribution of 1.192 and statistically significant at one percent. This indicates a direct relationship meaning rate of repayment increases with increasing educational level of farmers. According to Ozowa (1997) and Bulcock et al. (2003), if farmers are uneducated and conservative, it can lead to managerial problems such as poor administration and diversion of funds.

Household size (X3) has a marginal contribution of -1.988 and was statistically significant at 5% level of probability. This may be attributed to the high cost of maintaining large household sizes in the study area. Dependents (X4) showed that a marginal and inverse relationship to repayment rate was significant at 5% level of probability. This is expected due to its high cost of maintaining large numbers which are dependent. Number of years of farming experience (X5) contributed about 1.326 and statistically significant at 1%. This implied that as farmers gain farming experience, their repayment rates also increases. Farm size (X6) contributes -1.561 and is significant at 1%. This could be explained by its high cost of cultivating large farms in the study area. The distance between home and source of loan (X7) although not significant, is inversely related to loan repayment. This is expected because increase in the farm distance increases farmers’ transaction cost, as well as cost of supervising financial institutions. The size of loan (X8) contributes 0.005 and is significant at 1% implies that the size of loan influences loan repayment to a large extent by small-holder farmers in the study area. This could result from the natural instinct of farmers trivializing small amounts of money.

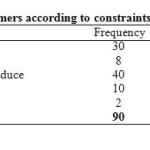

Problems that Constrained Farmers’ Loan Repayment

Majority (44.4%) of the beneficiaries complained of low market price of farm produce, followed by high interest rate (33.3% ) charged by the banks, while raising cost of production was the last constraint with 2.2%. Table 8 gives the representation.

|

Table 8: Distribution of farmers according to constraints to loan repayment. Click here to View table |

Conclusion and Recommendations

This study has shown that maize farmers in the area were yet to fully embrace improved varieties of maize. A reasonable proportion of the respondent had access to credit from informal sources while a large number received loan less that ₦51,000.00. With regard to loan utilization, purchase of input, hiring of labour and expansion of farm production were the major consumers of the loan. Factors that significantly affect loan repayment include age, education, household size, dependents and size of loan. These led to the recommendations that farmers’ loan size should be increase and released on time to enable them use it effectively. In addition, farmers should be encouraged to undergo formal educational training so as to easily acquire administration skills in the management of agricultural loans.

Acknowledgements

The authors wish to express gratitude to God for the wisdom, knowledge and understanding He displayed in the course of carrying out this research work.

References

- Agbugba, I.K. Marketing of dry season vegetables in Southeast Nigeria, Unpublished Ph.D Thesis in the Dept of Agricultural Economics, University of Nigeria, Nsukka (2014).

- Agbugba I.K., Nweze N.J., Achike A.I. & Obi A. Market Structure, Conduct, Channel and Margin of Dry Season Okra Vegetable in South-Eastern Nigeria; 2013 Presented inMelaka, Malaysia and Published in the Proceedings of the International Conference on Food and Agricultural Sciences, IPCBEE Volume 55 pp 73-78. (Available on online at http://ipcbee.com/list-83-1.html) (2013).

- Akintoye H.A., Adekunle A.A. and Kintomo A.A. The role of training in urban and peri-urban vegetable production: The case study of Leventis Foundation Agricultural Schools in Nigeria, Learning Publics Journal of Agriculture and Environmental Studies Vol.2 (2).21- 40 (2011).

- Arene, C.J. Loan repayment and technical assistance among smallholder maize farmers in Nigeria. In: African review of money, finance and banking, A Supplement of Savings and Development Journal, 1, 65-70 (1992).

- Bulcock P., Haylor G. and Savage W. Investigating Improved Policy on Aquaculture Service Provision to Poor People Mach 2002 – May 2003, A Review of Lessons Learnt in Enabling “People’s Participation in Policy-making Processes In: Association with Gramin Vikas Trust (GVT), DFID NRSP Research Project R8100, STREAM (Support to Regional Aquatic Resources Management April 2003, pp 1-32 (2003).

- CBN. CBN Economic Report for the First half of 2011, Central Bank of Nigeria, Abuja (2011).

- CBN Economic Report for the First half of 2011, Central Bank of Nigeria, Abuja (2011).

- Chiona S. Technical and allocative efficiency of smallholder maize farmers in Zambia. An M.Sc thesis submitted to the Department of Agricultural Economics, The University of Zambia, Lusaka, Zambia (2012).

- Hyande A.A., Oboh V.U. and Ezihe J.A.C. Loan repayment among smallholder maize farmers in Kalke Local Government Area, Plateau, Nigeria. Consolidation of growth anddevelopment of agricultural sector; Proceeding 9th Annual National Conference of Nigeria Association o Agricultural Economists (NAAE) held a Abubakar Tafawa Balewa University, Bauchi Nov 5 – 8, 2007, pp 110 – 114 (2007).

- Nmadu J.N., Bako A.N., Baba K.M. Micro-credit requirement , acquisition and repayment by vegetable farmers in Nigeria, IJTEMT Volume 2, Issue 6, Dec, (2013).

- Ololade R.A. and Olagunju F.I. Determinants of access to credit among rural farmers in Oyo State, Nigeria. Global Journal of Science Frontier Research, Agriculture and Veterinary Sciences, Volume 13, Issue 2, version 1.0, pp 16-22 (2013).

- Ozowa V.N. Information needs of small-scale farmers in Africa: The Nigerian Example. CGIAR (Consultative Group on International Agricultural Research) News, Volume 4, No 3 June 1997. Retrieved from:http://www.worldbank.org/html/cgiar/newsletter/june97/9cnews.html on 28/04/2014 (1997).

- World Bank Agriculture for Development. World Bank Development Report, 2008. http://siteresources.worldbank.org/INTWDR2008/Resources/WDR_00_book.pdf. (2008).