Introduction

Owing to various uses of soybean worldwide; such as bio-fuel, animal feed, cleaning products, fertilizers, cosmetics, pharmaceuticals along with uses in kitchen for direct consumption as a good source of protein and vegetable fat in the form of edible oil, tofu, soymilk, soy cheese and yoghurt etc. soybean is often called as the “Miracle Crop”. It contains around 40 per cent protein and 20 per cent oil. The origin of soya bean is dated back to around 5000 years ago in China and it was introduced in India and other neighboring countries between first century AD and 1100 AD.1 Soybean was initially introduced as a fodder crop in most of the countries including India, but its cultivation showed unexpected growth as oilseed crop in India after 1970s.1 In terms of area, soybean, rapeseed-mustard and groundnut account for around 90 per cent share in India, but it accounts for only 30 per cent of the domestic need for oilseeds. Soybean oil is the second most imported oilseed in India after palm oil. Import of soybean oil in India are mainly from Brazil and Argentina while India exports soybean and its products like soy meals and oilcakes to countries like Canada, Nepal, USA, UAE, Vietnam, Japan, Thailand, and Indonesia etc. In the year 2020, India ranked 20th in soybean export in the world, exporting $50.6 Million and it became 29th largest importer of soybeans in the world, importing $229 Million. Globally the major soybean producing countries include United States, Brazil, Argentina, China, India, and Paraguay. India ranks 5th among the leading producing countries in soybean production, while in terms of consumption it ranks 6th among the leading consuming countries. According to the data published by Statista Research Department by the end of year 2021-22 annual soybean production in India accounted for 12.61 million metric tons and by the end of year 2022-23 India was estimated to produce around 13 million metric tons.2 The leading soybean producing states in India include Madhya Pradesh, Maharashtra, Rajasthan, Karnataka, Gujarat etc. Madhya Pradesh ranks first in soybean production in the country and is often known as India’s ‘Soybean bowl’. Madhya Pradesh accounts for 55 per cent of the country’s soybean acreage. The Malwa agro-climatic zone of Madhya Pradesh is one of the best suited areas for soybean cultivation because of its soil and climatic conditions.3

Soybean is consumed directly as well as it’s by products such as soy oil and soy meals are also of great importance. Of the total production of soybean, about 10 per cent is used for direct consumption and 90 per cent is processed as oil and animal feeds. Soybean pass through various processes during the extraction of soybean oil, which can be done by mechanical method or by solvent extraction method.4 With the rapidly growing livestock sector, soy meal has emerged as world’s most significant source of protein and is widely used in animal feeds, as it is high in crude and digestible protein and low in fiber.5 Indian soy meal export is in great demands due to the production of non-GM soybean meals since most of the countries are producing GM soybean, which have various disadvantages and are reported to be harmful for human and animal health. Although, USA is second leading producer of soybean but it imports non-GM soy meal from India in large quantities.3 Other than US the major export market for Indian soy meal include Southeast Asian Nations, the Middle East as well as some European countries. According to the publication of USDA in the year 2021-22 India exported 1.70 million metric tons of soy meal globally. In this research paper attempts have been made to analyse changing pattern of soy meal export from India. Various studies had been undertaken in this aspect, one of which includes the study conducted by Pandey et al. (2002)7 to analyse the export potential of soy meal from India during 1981 to 1998. The findings of the study indicated that far east countries, particularly Singapore emerged as the largest export market for India exporting nearly 63.85 per cent of total soy meal export followed by Indonesia and Thailand. The study concluded that the growth trends showed area to be stabilised at 8-12 million hectares leading to nearly 12 to 15 million tons production in the next decades and amid low domestic consumption India had high export potential for soy meal. Another study conducted by Sharma et al. (2014)5 using Revealed comparative advantage index to estimate competitiveness of soy meal export indicated that India, Argentina, Paraguay and Brazil had comparative advantage in soy meal export while USA and Netherlands had comparative disadvantage. It further showed that India’s comparative advantage declined after the liberalization of oilseed sector. It further indicated that India, Turkey and Venezuela imposed higher import tariff on soy meal and oil and suggested India to impose zero tariff like China in order to increase capacity utilization of soy crush industry and realise food security in terms of edible oil availability.

Methodology

The present study is based on secondary data. The data on export quantity and value of export of soybean from India was collected from UN COMTRADE (https://comtrade.un.org/data) and data on production of soybean was collected from SOPA website (https://www.sopa.org) The study was conducted for a period of 20 years i.e., from 2000-01 to 2020-21. The various tools used for analysis of data are as follows:

Absolute change

Absolute change is the total change in the export quantity/value in a fixed amount of time. It is absolute difference between initial and final amount over a period of time by using the following formula:

Absolute change = An– Ao

Where,

An= Current year export quantity/trade value of export of soybean

Ao= Base year export quantity/trade value of export of soybean

Relative change (RC)

Relative change is a fraction, which expresses the absolute change as percentage with respect to the base year value. Relative change was estimated by using the following formula:

Where,

An and Ao have the same interpretations as given above in absolute change.

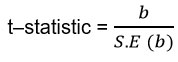

Compound Annual Growth rate (CAGR)

CAGR was used in the study to estimate the annual growth rate of export quantity and value over a period of time. CAGR was estimated by using the following formula:

Yt = abt

Compound annual growth rate (%) = (Antilog b-1) × 100

Where,

Y= Quantity/value of export of soybean

t= Time in year

b = Regression coefficient

Results and Discussion

The results of analyzed data were presented for different aspects of soybean and its exportable products. Data present in Table 1 shows the production of soybean in important soybean producing countries for a period of 2018-19 to 2020-21 and their percentage in total production. From the data, it can be revealed that Brazil is the leading producer of soybean globally with the production of 137 million metric tons in the year 2020-21 and with highest share in production in the world with 36.18 per cent. Following Brazil, USA is second most leading producer of soybean in the world with 30.97 per cent share in production. Globally, India ranks 5th in production of soybean accounting for 10.45 million metric tons in the year 2020-21 with production share of 2.88 per cent. From the data, it can be observed that with a slight fall in total production of soybean globally in the year 2019-20 there had been increasing trend in production of soybean with 364.07 million metric tons in the year 2020-21. The share of India in global soybean production was highest in year 2018-19 and then with a small decline in year 2019-20, again its share increased in year 2020-21 with 2.87 per cent.

Table 1: Important Soybean producing countries in the world

(Million Metric Tons)

| S.

No. |

Country | Production | Triennium Average | Percentage to total | ||

| 2018-19 | 2019-20 | 2020-21 | ||||

| 1 | Brazil | 119.70 | 128.50 | 137.00 | 128.40 | 36.18 |

| 2 | USA | 120.52 | 96.66 | 112.55 | 109.91 | 30.97 |

| 3 | Argentina | 55.30 | 48.80 | 47.00 | 50.37 | 14.19 |

| 4 | China | 15.96 | 18.10 | 19.60 | 17.89 | 5.04 |

| 5 | India | 10.93 | 09.30 | 10.45 | 10.23 | 2.88 |

| 6 | Paraguay | 8.52 | 10.10 | 9.90 | 9.51 | 2.68 |

| 7 | Canada | 7.42 | 6.15 | 6.35 | 6.64 | 1.87 |

| 8 | European Union | 2.67 | 2.62 | 2.58 | 2.62 | 0.74 |

| 9 | Mexico | 0.34 | 0.24 | 0.24 | 0.27 | 0.08 |

| 10 | Other | 19.93 | 18.96 | 18.40 | 19.09 | 5.38 |

| 11 | World total | 361.28 | 339.42 | 364.07 | 354.92 | 100.00 |

| 12 | Share of India | 3.03 | 2.74 | 2.87 | 2.88 | – |

Source: Oilseeds-World Markets and Trade, a USDA Publication

The above data clearly revealed that India ranked fifth in global production of soybean during last three years with marginal annual fluctuations. In Argentina, soybean production declined drastically from 55.30 million metric tons in the year 2018-19 to 47.00 million metric tons in the year in the year 2020-21. In rest of major soybean countries like Brazil, USA and China, soybean production continuously showing increasing trend. Soy oil and soy meal are the major products of the soybean traded globally. The data presented in Table 2 shows their production in the India along with its share in global production. Both these products have various uses and hence have great demand globally. Over the years the production of both the products had been observed to increase in India.

Table 2: Production of Soy oil and Soy meal in India and its share in world

(Million metric tons)

| Year | Soy oil | Soy meal | ||||

| India | World | Share in world (%) | India | World | Share in world (%) | |

| 2018-19 | 1.73 | 55.89 | 3.09 | 7.68 | 233.81 | 3.28 |

| 2019-20 | 1.51 | 58.36 | 2.59 | 6.72 | 244.49 | 2.75 |

| 2020-21 | 1.69 | 60.44 | 2.80 | 7.52 | 252.98 | 2.97 |

Source: Oilseeds- World Markets and Trade, USDA Publication

The share of India in production of both the products had dropped slightly in year 2019-20 compared to previous years, but again it increased during the year 2020-21. For soy oil, highest production was observed in year 2018-19 with 1.73 million metric tons, which accounted to 3.09 per cent globally. For soy meal also, highest production was observed in year 2018-19 with 7.68 million metric tons accounting to 3.28 per cent share globally. The global share of soy oil and soy meal was almost equal in percentage terms and they are proportionately related to total production of the soybean in the India during different years. The data presented in Table 3 shows changes and growth in the export quantity of soybean and soy meal from India during the period of two decades when soybean production in India was at boom (2000-01 to 2020-21).

Table 3: Absolute, relative changes and growth rate of export quantity of soybean and soy meal from India (2000-01 to 2020-21)

(‘000 tons)

| Export quantity | |||||

| Products | Base year | Current year | Absolute change | Relative change (%) | Growth rate

(%) |

| Soybean

(HS Code 120810) |

25.18 | 128.53 | 103.35 | 410.52 | 6.69** |

| Soy meal

(HS Code 2304) |

2253.20 | 1585.27 | -667.93 | -29.64 | -1.81 |

Base year-Average of triennium ending average of 2000-01 and 2002-03

Current year- Average of triennium ending average of 2018-19 and 2020-21

**significant at 1% level of significance

From the data presented in above table, it can be seen that the quantity of soybean exported over the years increased with a relative change of 410.52 per cent, whereas for export of soy meal negative relative change of -29.64 per cent was observed. Soybean export increased with a growth rate of 6.69 per cent per annum and was significant on the contrary export of soybean meal recorded a growth rate of -01.81 per cent and non-significant. In absolute terms, the soybean export was increased by 103.35 thousand metric tons during the last two decades. Soybean exports from India had increased in the previous year owing to the Iran’s markets opening up as a result of U.S. sanctions. But export of the soy meal decreased by 667.93 thousand metric tons and that may be due to increased use of soy meal domestically. India consumed an estimated volume of over six million metric tons of soybean meal in fiscal year 2022, which was only seven thousand metric tons during 1917. There was a consistent increase in the quantity of domestic consumption since fiscal year 2016. Soybean meals were used mainly in food and animal feeds as a protein supplement. Another factor is production of non-GMO soybean by competing countries like Brazil. Mato Grosso, the largest producer at the state level in Brazil, producing local non-GMO soybean and this was increase by 34 per cent over last year.8

Table 4: Change in export value of soybean and soy meal from India

|

Products |

Export value

(Rs. Lakh) |

Per unit value

(Rs. / tons) |

||||||

| Base

year |

Current

year |

Change

(%) |

CAGR

(%) |

Base

year |

Current year | Change

(%) |

AGR

(%) |

|

| Soybean

(HS Code 120810) |

3264.17 | 53569.04 | 1541.12 | 10.14** | 14000 | 42000 | 200 | 3.23** |

| Soy meal

(HS Code 2304) |

190683.48 | 554767.90 | 190.94 | 02.53*** | 9000 | 36000 | 300 | 4.20** |

Base year-Average of triennium ending average of 2000-01 and 2002-03

Current year- Average of triennium ending average of 2018-19 and 2020-21

**significant at 1% level of significance

***significant at 5% level of significance

The change in export value of soybean during current year over the base year was 1541.12 per cent with the annual growth rate of 10.14 per cent showing that the change in value of export of soybean over the value of soy meal was higher with higher growth rate (Table 4). This revealed that the value of soybean in export market increase at much higher rate as compared to increase in value of soy meal and this may be due to competitive soy meal market in the world. But on the contrary, the change in per unit value of soy meal was higher (300%) as compared to soybean (200%). The growth rate of per unit value of soy meal was also higher (4.20%) as compared to growth rate of per unit value of soybean (3.23%). Significant growth rate of export value and per unit value of export was observed for both the commodities.

From the above table, it is also clear that from India export of soy meal was higher as compared to soybean, but lower growth rate of export value over the years clearly indicating that some other countries are competing the Indian export in world trade of soy meal due to increase awareness about non-GMO soybean in GMO soybean producing countries like Brazil, USA etc.

Recently due to shortfall in the supply of soybean, Indian government permitted import of genetically modified soy meal for poultry consumption. There had been decline in soy meal export from India to 42,383 tons in November 2021 from 1,98,776 tons in the previous year, according to data released by the Solvent Extractors’ Association9 (SEA). Amongst this supply shortfall and rising prices in market, India which is exporter of soy meal had started importing in the recent years. Although amid the rising awareness of non-GM soybeans there is potential for rise in export of Indian non-GM soy meal and efforts are required to be made by researchers and government regarding development of different value-added products of soy meal specially for malnourished population of the country.

In Table 5 the data on export of soy meal from India to different destination countries are presented. The data shows that during the base year (TE 2003), maximum quantity of soy meal was exported to Indonesia (16.73%) followed by Republic of Korea (12.30%), Thailand (9.93%) and Vietnam (8.74%). Very negligible quantity of soy meal was exported to European union and other developed countries during the base year. But during current year (TE 2020), maximum quantity was exported to USA (18.77%), which was very meager (0.02%) during the base year showing that the demand for soy meal increased many folds in USA and on account of non-GMO soybean production in India, USA traders preferred to import soy meal from India. Similarly, Nepal and France emerged as major importer of soy meal from India with 8.49 per cent share of total soy meal exported from India during the current year. In terms of relative change of export to different countries, it was maximum for USA followed by Germany.

In terms of compound growth rate of export of soy meal from India to different countries, again it was highest for USA (20.87%) followed by France (19.03%), Myanmar (17.28%) and Germany (13.05%). Drastic reduction of export of soy meal from India to UAE was noted with declining growth rate of 9.58 per cent.

Table 5: Absolute, relative changes and CAGR of quantity of soy meal exported from India

| Export quantity (tons) | ||||||||

| S. No. | Country | Base year | Share

(%) |

Current year | Share (%) | Absolute change | Relative change (%) | CAGR (%) |

| 1. | Vietnam | 197019.31 | 8.74 | 45579.00 | 2.88 | -151440.31 | -76.87 | -6.82** |

| 2. | Japan | 140914.12 | 6.25 | 83707.74 | 5.28 | -57206.37 | -40.60 | -2.07 |

| 3. | Indonesia | 376869.99 | 16.73 | 10169.45 | 0.64 | -366700.54 | -97.30 | -9.10** |

| 4. | Thailand | 223829.97 | 9.93 | 18731.43 | 1.18 | -205098.54 | -91.63 | -7.02** |

| 5. | Republic of Korea | 277168.04 | 12.30 | 61182.97 | 3.86 | -215985.07 | -77.93 | -4.91** |

| 6. | Nepal | 1240.13 | 0.06 | 134535.15 | 8.49 | 133295.02 | 10748.50 | 9.62** |

| 7. | France | 906.93 | 0.04 | 134630.31 | 8.49 | 133723.38 | 14744.57 | 19.03** |

| 8. | USA | 467.01 | 0.02 | 297626.82 | 18.77 | 297159.81 | 63630.65 | 20.87** |

| 9. | UAE | 37419.23 | 1.66 | 745.05 | 0.05 | -36674.18 | -98.01 | -9.58** |

| 10. | Myanmar | 131.30 | 0.01 | 40036.33 | 2.53 | 39905.03 | 30392.26 | 17.28** |

| 11. | Malaysia | 49145.91 | 2.18 | 5218.83 | 0.33 | -43927.08 | -89.38 | -4.89*** |

| 12. | Germany | 89.33 | 0.004 | 43384.40 | 2.74 | 43295.07 | 48464.63 | 13.05** |

| 13. | Other | 948004.10 | 42.07 | 709721.17 | 44.77 | -238282.92 | -25.14 | -1.20 |

| 14. | Total | 2253205.37 | 100.00 | 1585268.67 | 100.00 | -667936.70 | -29.64 | -1.61 |

Base year= Average of triennium ending between 2000- 2002

Current year=Average of triennium ending between 2018-2020

**significant at 1% level of significance

***significant at 5% level of significance

The declining growth rate of export of soy meal from India was also noted for countries like Indonesia (-9.10%), Thailand (-7.02%) and Vietnam (-6.82%). In all, the export of soy meal from India declining at the rate of 1.61 per cent per annum and this may be due to domestically increased use of soy meal followed by conversion of GMO soybean production to non-GMO soybean production by competing countries like Brazil and China.

Table 6: Absolute, relative changes and CAGR of trade value of soy meal exported from India

(Rs. Lakhs)

| S. No. | Country | Base year | Current year | Absolute change | Relative change (%) | CAGR

(%) |

| 1. | Vietnam | 17290.46 | 13084.41 | -4206.05 | -24.33 | -3.10 |

| 2. | Japan | 11205.18 | 28706.26 | 17501.07 | 156.19 | 2.01 |

| 3. | Indonesia | 29903.88 | 3880.38 | -26023.49 | -87.02 | -5.02** |

| 4. | Thailand | 19203.34 | 5776.81 | -13426.53 | -69.92 | -3.14 |

| 5. | Republic of Korea | 22493.37 | 22958.18 | 464.80 | 2.07 | -0.57 |

| 6. | Nepal | 125.58 | 45230.16 | 45104.58 | 35918.29 | 13.83** |

| 7. | France | 38.12 | 40492.38 | 40454.26 | 106111.29 | 24.40** |

| 8. | USA | 36.90 | 128291.62 | 128254.72 | 347566.72 | 25.85** |

| 9. | UAE | 3461.55 | 177.61 | -3283.94 | -94.87 | -6.54*** |

| 10. | Myanmar | 13.04 | 12861.23 | 12848.19 | 98494.37 | 21.21** |

| 11. | Malaysia | 4372.76 | 1908.83 | -2463.93 | -56.35 | -0.84 |

| 12. | Germany | 7.64 | 14017.71 | 14010.07 | 183284.97 | 17.42** |

| 13. | Other | 82531.16 | 237382.25 | 154851.08 | 187.63 | 2.85*** |

| 14. | Total | 190683.01 | 554767.83 | 364084.83 | 190.94 | 2.53*** |

Base year = Average of triennium ending between 2000- 2002

Current year =Average of triennium ending between 2018-2020

**significant at 1% level of significance

***significant at 5% level of significance

In terms of trade value, the share of Indonesia was highest (15.68%), followed by Republic of Korea (11.80%) during the base year as shown in table 6. During the current year scenario has been change completely for export of soy meal from India. In the current year the share of trade value of export of soy meal from India was highest for the USA (23.12%), followed by Nepal (8.15%).

The annual compound growth rate of export value was highest for USA (25.85%), followed by France (24.40%), Myanmar (21.21%) and Germany (17.42%). The highest decline in trade value was observed for UAE (-6.54%), followed by Indonesia (-5.02%).

Table 7: Absolute, relative changes and CAGR of per unit trade value of soy meal exported from India to various countries

(Rs. /ton)

| S. No. | Country | Base year | Current year | Absolute change | Relative change (%) | CAGR (%) |

| 1. | Vietnam | 8900 | 32600 | 23712 | 266.00 | 3.98** |

| 2. | Japan | 8700 | 36100 | 27358 | 314.25 | 4.16** |

| 3. | Indonesia | 8300 | 38000 | 29682 | 355.60 | 4.49** |

| 4. | Thailand | 8500 | 35300 | 26807 | 315.78 | 4.18** |

| 5. | Republic of Korea | 8400 | 37800 | 29330 | 347.27 | 4.57** |

| 6. | Nepal | 10149 | 33929 | 23780 | 234.30 | 3.84** |

| 7. | France | 6080 | 31648 | 25568 | 420.52 | 4.51** |

| 8. | USA | 9158 | 42927 | 33769 | 368.73 | 4.12** |

| 9. | UAE | 9188 | 21759 | 12570 | 136.81 | 3.35** |

| 10. | Myanmar | 9651 | 34136 | 24484 | 253.68 | 3.35** |

| 11. | Malaysia | 9653 | 36825 | 27172 | 281.49 | 4.26** |

| 12. | Germany | 11127 | 36933 | 25806 | 231.92 | 3.87** |

| 13. | Other | 8724 | 34232 | 25508 | 292.38 | 4.10** |

| 14. | Total | 8570 | 35630 | 27065 | 315.93 | 4.20** |

Base year = Average of triennium ending between 2000- 2002

Current year =Average of triennium ending between 2018-2020

**significant at 1% level of significance

The total trade value did not depict the clear picture of the foreign reserve generated through export of the soy meal and thus per unit value of the export of the soy meal during both the period for different countries were worked out and data on the same are presented in Table 7.

The data presented in table 7 clearly indicating that there was overall growth of 4.20 per cent in per unit trade value (Rs/ton) for soy meal with relative change of 315.93 per cent and absolute change of Rs. 27065 per ton in totality. The maximum per ton trade value during the base year was realized from Germany (Rs. 11127/ton), but total export of soy meal during the base year to Germany was very negligible. During the current year, the highest price realization is from USA (Rs. 42927/ton) and in term of share in export quantity and thus total export value was also higher for USA. The least price realization for soy meal export is from UAE and thus the export of soy meal to UAE was declined drastically. For other importing countries, it ranges from Rs. 30000 to 40000/ton. The growth in per unit trade value realization from export of soy meal from India revealed that it was increased with highest rate of growth for France (4.51%) and least for UAE and Myanmar (3.35%).

For export of soy meal globally, India is competing mainly with Argentina, Brazil, China and USA. The data on per cent share of export of soy meal from India and competing countries is given in table 8.

Table 8: Absolute, relative changes and growth rate of quantity of soy meal traded globally by major countries

| S.No. | Country | Base year

(000’ tons) |

Share

(%) |

Current year

(000’ tons) |

Share

(%) |

Absolute change

(000’ tons) |

Relative change (%) | CAGR (%) |

| 1. | India | 2253.21 | 05.36 | 1585.27 | 02.33 | -667.94 | -29.64 | -1.61 |

| 2. | Argentina | 14584.46 | 34.67 | 24271.83 | 35.66 | 9687.37 | 66.42 | 1.18** |

| 3. | Brazil | 11047.96 | 26.26 | 16766.12 | 24.63 | 5718.15 | 51.76 | 1.32** |

| 4. | China | 452.43 | 01.08 | 1029.93 | 01.51 | 577.50 | 127.64 | 3.92** |

| 5. | USA | 6261.57 | 14.89 | 9974.76 | 14.66 | 3713.19 | 59.30 | 1.51** |

| 6. | Other | 7466.66 | 17.75 | 14433.97 | 21.21 | 6967.31 | 93.31 | -2.36 |

| 7. | Total | 42066.28 | 100.00 | 68061.87 | 100.00 | 25995.59 | 61.80 | 1.06** |

Base year= Average of triennium ending between 2000- 2002

Current year=Average of triennium ending between 2018-2020

**significant at 1% level of significance

In the base year, globally Argentina accounts for 34.67 per cent of soy meal traded globally, followed by Brazil (26.26%) and USA (14.89%). India’s share in global trade of soy meal was 5.36 per cent only in the base year which decline to 2.33 per cent during the current year. Globally trade of soy meal is increasing at the rate of 1.06 per cent per annum. During current year, the share of Argentina, Brazil and USA in global trade of soy meal was almost same as it was observed during base year but change of absolute quantity traded was highest Argentina, followed by USA, although it was second highest for China, but its share in global trade of soy meal was negligible (1.51%). Share in export of soy meal from India in terms of annual growth rate and relative terms decline over the period of two decades.

Conclusion

From the ongoing discussion it can be concluded that India is among the top 5 soybean producers in the world. The export of soybean was observed to be increased continuously over the period. The two main soybean by-products include soybean oil and soybean meal, India is a major importer of soybean oil whereas for soy meal India is one of the major exporters with high demand specially in USA due to its non-GM nature. Over the years, positive growth rate had been observed in soybean export in terms of both quantity and value of export, however for soy meal growth rate was positive for value of export but negative for the export quantity. Among the major importing countries of soy meal from India, Republic of Korea emerged as the major country with positive growth rate in terms of per unit value of import of soybean meal, followed by Indonesia. Among the major exporters, China emerged as the highest exporter with highest growth rate of quantity exported of soy meal, followed by USA, whereas India recorded negative growth rate in export of soy meal to world.

Acknowledgment

This paper is part of the author’s (Poonam Chaturvedi) PhD Non-thesis research article at Department of Agricultural Economics and Farm management, College of agriculture, Jabalpur JNKVV, India.

Conflict of Interest

The authors declare no conflict of interest.

References

- Singh, B. B. Success of soybean in India: the early challenges and pioneer promoters. Asian Agri-History. 2006;10 (1), 43-53.

- Minhas, A. Soya bean production volume in India FY 2013-2023.4. https://www.statista.com/statistics/769822/india-soya-bean-production-volume/.2023.

- Maish, D.J. Bajpai, D.A., &Kaur, D. Indian soybean: the wonder crop. International Journal of Agricultural Science and Research (IJASR). 2022;12(1), 97–108.

- Banaszkiewicz, T. Nutritional value of soybean meal. Soybean and nutrition, 2011;12,1-20.

CrossRef - Sharma, P., Patel, R. M., & Srivastava, S. K. Comparative advantage of Indian soy meal vis-à-vis major exporters. Soybean Research. 2014;12(1), 129-143.

- Persaud, S. Impacts on India’s Farmers and Processors of Reducing Soybean Import Barriers. OCS-19J-02. USDA, Economic Research Service.

- Panday, S. K., Joshi, O. P., & Nahatakar, S. B. Export Potential of Soya-meal from India. Agricultural Situation in India. 2002; 59(2), 73-78.

- Growth in the Brazilian non-gmo soybean production. Proterra foundation. https://www.proterrafoundation.org/news/growth-in-the-brazilian-non-gmo-soybean-production.,2022.

- India’s Nov oil meal exports down 51 pc; soybean meal export unlikely next 2-3 months: SEA. The Economic Times. India’s Nov oil meal exports down 51 pc; soybean meal export unlikely next 2-3 months: SEA

0 Replies to “Dynamics of Export of Soy Meal from India”