Introduction

In India tobacco is grown on around 4.93 lakh hectares of area accounting for about 0.24% of total arable land in the country (Tobacco Board 2013). India accounts for 10% of world’s area under tobacco and about 9% of tobacco production (www.ctri.org.in). India produces on an average 800 million kg (dry weight) of tobacco (Tobacco Board 2013). India emerged as the second largest producer of tobacco (www.statista.com) in the world replacing USA, in 2002. Tobacco is a half yearly crop. Indian farmers are growing tobacco for several years and are acquainted with its cultivation practices. Tobacco is grown largely in 15 states of the country. Flue Cured Virginia (FCV), cigar, cheroot, bidi, chewing, hookah, snuff, natu and burley tobacco are grown in different parts of the country. While FCV tobacco is generally used for cigarette making, some quantity of burley and natu tobacco is used as blends in cigarette making. FCV tobacco is grown in Karnataka and Andhra Pradesh (AP). Small quantity of this tobacco is also grown in Orissa (Rayagarh) and Maharashtra (Gadchiroli). Tobacco is a commercial crop and contributes to the exchequer in terms of foreign exchange and excise earnings and supports people engaged in production, processing, marketing and exports including farmers, bidi rollers, tendu leaf-pluckers and retailers. It contributed 19,891.50 crores as excise duty and 4979 crores in foreign exchange to the national exchequer in 2012-13 (Tobacco Board 2013).

However, tobacco is considered a de-merit good because of the adverse effects on the health of its consumers (A de-merit good in economics refers to a good or service, which is unhealthy or socially desirable. And the negative effects of the good or service may be unknown or ignored by consumers. Sometimes its consumption may have adverse effects on third party due to its negative externality. And, sometimes a de-merit good may be over consumed if left to market forces and, therefore requires government intervention to regulate its production and supply). The increasing evidence on the adverse health consequences of tobacco consumption has intensified worldwide efforts to combat its use and production. WHO predicts nearly one million deaths every year in India on account of tobacco consumption and passive smoking. Article 17 and 18 of WHO’s Framework Convention on Tobacco Control (FCTC) lay stress on existing gaps in research and emphasize that the parties should promote research related to health/ environmental and socio-economic aspects and economically viable and sustainable alternatives to tobacco crop. Therefore, in addition to the taxation policy that aims at reduction of demand, an important state policy action under review, in developed and underdeveloped countries is to curb tobacco production by encouraging the cultivation of alternative crops and alternative livelihoods. India is one of the Parties to the FCTC, which is an international treaty that sets out obligations for countries to effectively reduce tobacco use. As a party to the treaty, India is obligated to take measures to bring down the consumption and production of tobacco in the country through an array of measures to be implemented gradually over the years.

Tobacco cultivation in India, particularly Flue Cured Virginia (FCV) tobacco used for cigarette making has been enjoying institutional support since several years, while on the other hand the Central government has been targeting cigarettes with tax hike in almost every budget. This indicates a paradox in the public approach to tobacco control. On the one hand government has initiated measures to combat tobacco consumption and on the other it promotes cultivation of tobacco, its sale, trade and exports. This is because different ministries of the government engage in promotion and prevention of tobacco use simultaneously. The overall losses due to tobacco use would surpass the gains if we take into account the health care costs, burden of mortality and environmental consequences of tobacco. Its cultivation causes problems generally referred to as ‘Green Tobacco Sickness” and a cause of environmental concern as fuel-wood is used extensively in its curing. Use of fertilizers is also higher in tobacco cultivation.

Then why do the government and policy makers are rigid on reducing the use of tobacco in the country? Although political motive exists in refraining from increasing tax rates on bidis and restricting tobacco cultivation, the government has been justifying its action on the grounds of large scale employment that is associated with tobacco. Thousands of farmers are engaged in cultivating different types of tobacco in the country. Everyday around 4 million people are rolling bidis in India, two-third of them being women. In addition farmers, retailers, processors, tendu leaf pluckers are dependent on tobacco for their livelihood. More importantly tobacco is one of the main sources of revenue to government. Tobacco contributed around 11% of the excise revenue in 2012 (CBECDDM 2013) and accounts for about 4% of the total value of India’s agricultural exports (www.ctri.org.in/) resulting in substantial foreign exchange earnings. The net returns from tobacco on an average appear to be 2-4 times higher than other crops like groundnut, cotton, black gram in Karnataka, Gujarat and Andhra Pradesh. This is the reason why farmers go in for tobacco cultivation

Economics of Tobacco Cultivation-Research Context and Review

There are some efforts being put in by the government to gather information on alternative farming and livelihoods although the magnitude of the effort and the coverage is too less, disintegrated and not continuous. The main reasons could be lack of coordination between concerned ministries and delays in taking decisions and implementation. Any kind of intervention to reduce supply of tobacco requires data on number of growers, socio-economic status of growers, feasibilities of alternative crops, availability of infrastructure, identification of factors that could enable shifting, and about farmers’ willingness to shift from tobacco cultivation. Unless such information is made available it is difficult to develop a comprehensive rehabilitative plan. Articles 17 and 18 of WHO’s FCTC lay stress on these points calling the tobacco growing countries to update their information on social and environmental costs of tobacco cultivation, scope for alternative crops and livelihoods and the need for involvement of farmers in decision making.

On tobacco cultivation, however there are very few economic studies in particular. As many tobacco farming studies are either based upon secondary statistics or crop budget analysis, there has been little scientific investigation of what farmers think (Geist et al., 2009) on tobacco cultivation and diversification. Based on the information collected from multiple sources including published literature, public testimonies and mail/telephone based sample survey of 100 farmers drawn from Tanzania, Germany, Taiwan and Brazil, Geist et al., (1999) confirm the trend in global shift of tobacco cultivation in to developing world and indicate the existence of more opportunities for diversifications. But, they find little effort put in this direction, particularly addressing the poor farmers. The computer assisted telephone interview of 1200 households in North Carolina (Altman et al., 1995) reveals the fact that as a whole, no other commodities generated the profits that tobacco produced per acre. Although there were individual specific profits with other crops, they were accompanied by huge investments in the rural infrastructure.

The price of the output, cash loans, availability of family labour, educational level and, access to fertilizers were stated to be the reasons explaining cultivation of tobacco according to a study carried out by Abdallah et al (2007) in Iringa district of Miombo woodlands of Tanzania. Similar results came out from a study by Akhter (2006) in Bangladesh. Cash earnings, perceived high profits, guarantee of inputs and market, credit advance and involvement of farmers through company cards played a major role in continuing tobacco cultivation in Bangladesh. In addition as revealed by this study there was commitment from the tobacco companies to procure tobacco leaves from the farmers directly on cash payment. On the other hand lack of support to food crops were reported to be making farmers not to continue their cultivation.

A study by Kibwage et al (2008) carried out in South Nyanza region of south western Kenya covering Kuria, Migori, Homa Bay and Suba districts showed that the bamboo cuttings planted under the same natural tobacco growing conditions in five zones with different land conditions could do well in tobacco region. But, they emphasized the need to extend the study to remaining tobacco zones to examine the replication of their findings.The study was carried out on 120 field experimentation sites where 2420 bamboo cuttings were planted. Capacity building through training and empowerment in bamboo farming and processing is recommended by authors as essential components facilitating diversification.

As we look into the literature in the Indian context there is absolute dearth of information on tobacco growers, particularly FCV tobacco cultivators for e.g. their background, perceptions on tobacco cultivation, hardships, alternative crops, etc. Results from some of the studies/experiments carried out in India discussed below indicate that shifting from tobacco is possible. A brief analysis of the cost: benefit ratio of tobacco and alternate crops suggests that although the returns are not very attractive for other crops, tobacco is not an ultimate for the traditional tobacco soils.Net returns for ground nut, red gram, soy bean, chilly and intercropping of various crops have been favourable in some regions. Farmers in Nippani tract of Karnataka have started growing sugarcane, banana and soy bean. In Gujarat farmers have been experimenting with banana and mustard in traditional tobacco soils. In 2000-01, farmers in Andhra Pradesh were encouraged to grow alternative crops due to crop holiday announced by Tobacco Board. Farmers’ meetings, suggestions on raising alternative crops, transfer of technology on alternatives crops, bank loans and supply of appropriate seeds were instrumental in inducing change. As a result of this intervention in 2004-05 crop seasons, farmers in central black soil region had diverted 20% of their land under tobacco to Subabul (Social Forestry)[1]. In central black soil / northern black soil and southern black soil areas the cultivation of cotton and chillies had increased. This shows that if, concrete efforts are put in by the government there can be a gradual shift from tobacco.

In Karnataka, Satyapriya and Govindaraju (1990) found that although net returns per hectare were more from bidi and FCV tobacco, the net income per rupee of investment was higher for groundnut (Rs.1.73) than bidi tobacco (Rs.1.50) and higher from horse gram (Rs.1.60) than FCV tobacco (Rs.1.18). However, they concluded that given the existing level of technology, the possibility of an alternative crop to tobacco, purely on economic grounds, does not exist. In another study carried out by Panchamukhi et al., (1998) the net returns per rupee of investment were found to be higher for sugarcane (Rs.0.87) than bidi tobacco (Rs. 0.57). Soy bean was next best crop, which earned returns (Rs.0.43) nearer to bidi tobacco.

In India reports on comparative experiments carried out by Agricultural Research Stations CTRI, Rajahmundry (1991-96) and Agricultural Research Station (ARS), Nippani (1992-94) at several intervals indicate net returns to be favourable for tobacco as a single crop, particularly in the case of FCV tobacco. But, with mixed cropping the returns were higher for crops other than tobacco. In bidi tobacco region of Nippani the field study by Bhat et al (1998) found returns to be higher for mixed crops as compared to tobacco.

Dinesh Kumar et al., (2010) from their study in Shimoga district of Karnataka carried out for three successive years (2003, 2004 and 2005), found sole FCV tobacco to be the most remunerative crop. However, they found that mixed cropping of other crops was more profitable

than tobacco. In the absence of single alternate crop to tobacco, the study suggests mixed cropping of hybrid cotton + chilli + groundnut and, hybrid cotton + chilli + French bean as alternative crop package to FCV tobacco. A recent study by Rao and Nancharaiah (2012) carried out in Prakasam district in Andhra Pradesh reveals paddy and Bengal gram to be more profitable than tobacco. The average input-output ratio per acre for all categories of farmers was found to be Rs.1.21 for paddy as against Rs.1.09 for tobacco in irrigated area and Rs. 1.34 for Bengal gram as against Rs. 1.11 for tobacco in rainfed area. The net returns per acre were higher by 60% for paddy in irrigated area and by 88% for Bengal gram in rain-fed area as compared to tobacco. The researchers state that many farmers in these villages have already given up tobacco and are growing other crops due to low price for tobacco, high cost of production and decreasing international demand.

In the background of the available literature discussed above a modest attempt has been made in this study to fill in the gap that exists in the available literature about situational analysis of economics of tobacco cultivation, identify economically viable alternate crops if any for FCV tobacco and challenges in shifting with reference to FCV tobacco in Karnataka.

Materials and Methods

This study is based mainly on primary data collected from tobacco grower and non tobacco grower households. The field survey was carried out in 2010 covering 2009-10 agriculture season. It should be noted that most of the districts in Karnataka were hit by heavy or excess rainfall during 2009 crop season as a result of which there was crop loss in many districts including tobacco growing region.

Hassan and Mysore are the two main districts growing FCV tobacco with their respective share of 80% and 17% in total production. FCV Tobacco cultivation is found extensively in Hunsur, Periyapattana, KRNagar and H.D.Kote taluks of Mysore district. In Hassan district it is grown mainly in Arakalgudu and Holenarasipura taluks. Both the districts are covered for the household survey. Total area under FCV tobacco in Karnataka during the year 2009 was 107,000 ha. All the blocks having more than 1% of registered tobacco growers (as percentage to total growers in the region) are included in the study. The number of villages covered for household survey is 20 allocated to selected six blocks of two districts in proportion to the percentage share of tobacco farmers per block to total tobacco farmers of the two districts. The first 20 villages with higher number of tobacco growers from the six blocks of two districts are included in the study. The number of households surveyed in each village is in proportion to the number of tobacco growers to the total tobacco growers of the selected 20 villages. The details of registered tobacco growers and the area planted in 2009-10 crop season for the States growing tobacco are given in Table 1 below.

Table 1: State-Wise Details of FCV Tobacco Growers and Area Planted (2009-10).

| Sl. No. | States | No of Growers | No of Barns | Area Planted (Hectares) |

| 1. | Andhra Pradesh | 46974 | 40053 | 149936 |

| 2. | Karnataka | 41038 | 56353 | 106602 |

| 3. | Maharashtra | 26 | 38 | 75 |

| 4. | Orissa | 84 | 102 | 212 |

| Total | 88551 | 96546 | 256825 |

Source: Tobacco Board, 2012 (indiantobacco.com)

The number of farmers registered for 2009-10 crop season was 41038 in Karnataka. This accounted for 46% of licensed tobacco growers in India. We covered around 1% of the registered FCV tobacco growers in Karnataka for the household survey, which amounted to around 400 tobacco growing households. To get a comparative picture of socio-economic status of households not growing tobacco and the reasons thereon for not cultivating tobacco, we tried to cover in each selected village 2 households growing crops other than tobacco. This was our control group. Although the targeted sample of non-tobacco households was 10% of the main sample i.e. 40 non-tobacco growers from 20 sample villages, we could not get any non-tobacco household in one of the villages and could get only one non-tobacco household in two of the villages. So the control group included only 36 non-tobacco growing households. So, in total we covered 436 farm households in our study. Structured and pre-tested schedules were used as instruments of data collection. These schedules facilitated collection of information on viz. socio-economic status of farm households, cropping pattern, cost of cultivation for different crops, yield, crop-wise income, livelihood sources and income, access to infrastructure, crop incentives/benefits, experiences with cultivation of other crops, willingness to shift from tobacco to other crops, etc.

In this study, we follow a simple calculation of costs to return based on the information on total costs of cultivation and returns in terms of gross income earned and net returns from the sale of crops. The production cost including expenditure on seeds, fertilizers/manures, labour, curing of the product, packaging and transport and any miscellaneous items is subtracted from the gross income accrued from the sale of crops or total value of the crops. The returns are calculated per standard unit of cultivated area and also as per unit of investment expressed in terms of one rupee (INR).

Results and Discusssion

What Promotes FCV Tobacco Cultivation?

The cultivation, marketing and sale of FCV tobacco in India has been promoted by the Tobacco Board, which is established by Government of India under the Tobacco Board Act of 1975. It regulates production and promotes marketing in India and overseas. The Tobacco Board Act aims at planned development of Tobacco Industry in the country. It arranges for auction of tobacco crop by establishing auction platforms for sale of FCV tobacco by registered growers and propagates information useful to the growers, dealers and exporters of FCV tobacco and manufacturers of tobacco products. It has been promoting tobacco grading at the level of growers and encourages scientific, technological and economic research for promotion of tobacco industry.

The information gathered from the Tobacco Board reveals that it provides subsidy to SC/STs, women, small and marginal and other farmers growing FCV tobacco, through supply of inputs viz., weighing scales, trays, tarpaulin sheets, insulation of barns, etc., and arranges for on-farm extension in the form of Model Project Area to help produce quality crop. The details of facilities extended annually by the Tobacco Board are given in Table 2 below.

Table 2: Extension Facilities Extended by Tobacco Board (2008).

| Name of the scheme | No. of Beneficiaries | Financial Expenditure (Rs. In lakhs) |

| 1. Farm Mechanization | 8751 | 127.94 |

| 2. Improving Yield & Quality of FCV tobacco | 6064 | 75.63 |

| 3. Improvement of curing practices | 7533 | 60.41 |

| 4. Model Project Area | 26213 | 28.42 |

| 48561 | 292.40 |

Source: Tobacco Board [accessed on 5-08-2011 at tobaccoboard.com]

In 2008, the Tobacco Board provided assistance to 48561 beneficiaries worth Rs. 292.4.lakhs. Other facilities extended by the Tobacco Board include, fixing of modified (venture) furnaces in place of traditional furnaces in the tobacco curing barns, insulation of barn roof, training on post harvest project management, loan tie-up arrangement with banks, training programmes for the benefit of farmers and field staff in collaboration with CTRI and Research Wing of ITC – ILTD (Indian Tobacco Company- Indian Leaf Tobacco Development Division) at different stages of crop growth, etc. Study tours, workshops and field visits are arranged for farmers to get them acquainted with the latest improved practices and adopt the same in their own fields. In addition, the Tobacco Board organizes supply of various inputs viz. fertilizers, pesticides / fungicides to growers every year at competitive prices and offers input loans at a competitive rate of interest of 6% to 6.5% per annum. In 2010-11FCV tobacco growers in Karnataka received fertilizers amounting to 34299.35 tons (Tobacco Board, Annual Report 2010-11) at a cost of less than Rs. 20 per kg. Quality seeds are procured from CTRI and ITC Ltd and supplied every year to the growers in the states of Andhra Pradesh and Karnataka at auction platforms. During the year 2009-10, a “Tobacco Board’s Growers’ Welfare Fund”, was created to implement the “Tobacco Board’s Growers’ Welfare Schemes”, with one time contribution of Rs.17.5 crores by the Tobacco Board. This is subject to the contribution from growers and the Tobacco Board in the ratio of 1:2 (Department of Commerce at commerce.nic.in). Over and above all these measures the Tobacco Board honors the best growers for achieving higher yields every year to encourage quality production and competition among the growers. It is clear from above discussions that FCV tobacco is a protected crop receiving institutional support at all stages of crop production right from supply of seeds/ seedlings to marketing of the crop. Any substitution to this crop has to be looked in this background considering infrastructure and other facilities available to tobacco growers.

Farm Household Characteristics-Tobacco Growers Vs. Non-Tobacco Growers

The household survey data shows that a majority (66%) of the tobacco growing households belong to backward castes in addition to 18% belonging to SCs and STs who follow Hindu religion. Only 6% of the households belong to Muslim religion. On farm agriculture is the main occupation (96%) of the households and around 2% have self-owned business. But, 23% of families reported agricultural labour as their sub-occupation. Other sub occupations reported by farm households include self-owned business (7.5%), salaried employment in private sector (5%), casual labour (3%) and agriculture (2.5%). Although 50% of the households own livestock viz. cow (29%), sheep (2%), goat (2%), chicken (3%), buffalo (5%), none reported livestock as the main occupation and less than 1% reported it as one of their sub occupations. Around 50% of the heads of households are illiterate, but 25% have education from the level of matriculation to graduation. As we investigated for the highest level of education in a family, it was found that 5% of the tobacco households do not have any educated members (totally illiterate families) and 17% of the families have at least one member who has completed graduation.

Since farmers reside in villages, except one all others have their own houses to live in. None of them live in huts and have decent houses to live in with availability of drinking water facility through private taps. According to Below Poverty Line (BPL) cards issued by government to identify beneficiaries under Public Distribution System (PDS), 56% of the households, which possess these cards can be considered as poor. But, if we consider the total annual income of the households none of the households fall below poverty line and earn >12,000 p.a., which generally was considered as the threshold for declaring provision of benefits to households under different poverty alleviation programmes of the government in rural Karnataka (see Table 3 below).

Table 3: Distribution of Households According to Annual Family Income (Rs.).

|

Category of households |

Income category |

||||

|

<=12,000 |

12,001-50,000 |

50,001-1,00,000 |

1,00,001-3,00,000 |

>3,00,000 |

|

|

Tobacco households |

0.0 |

0.75 |

5.0 |

73.25 |

21 |

|

Non-tobacco households |

0.0 |

52.8 |

41.7 |

5.5 |

0.0 |

The social background of non-tobacco households in terms of religion and caste is almost similar to that of tobacco households except that a higher percentage of non-tobacco households belong to backward castes. Illiteracy appears to be higher among non-tobacco households as 61% of the heads of the households are illiterate as compared to 50% of the heads of households in tobacco growing households. Other than this we did not find major differences between the two categories of households in attainment of highest level of education of the household members. By counting of family cards given to beneficiaries of PDS, it is found that the percentage of households lying below poverty (BPL) is higher among non-tobacco growing households (83%) than among tobacco growing households (57%). The percentage of households owning irrigated land is also higher among tobacco households than non-tobacco households. And only 55% of non-tobacco households have private tap connected to their houses as against 77% of tobacco growing households having private tap connected to their houses for collecting water. If we look into other socio-economic characteristics of tobacco vs. non-tobacco households (Table-4), at the very first glance it appears that most of the characteristics are supportive or conducive to the cultivation of tobacco.

Firstly, tobacco cultivation is a labourious activity involving various stages of production viz. bed preparation, seedling, nursery maintenance, planting, weeding, application of pesticides, leaf plucking, curing, grading, packaging, transport and auctioning of leaves. In rural areas it is very difficult for farmers to get hired labour. Therefore, family labour assumes importance in tobacco cultivation. It should be noted that the average size of the family in tobacco households is higher than that in non-tobacco households. And 50% of the tobacco families stay in joint families as compared to 36% of the households in non-tobacco households.

Table 4: Comparative Scenario of Tobacco Vs. Non-Tobacco Households.

| Sl. No. | Categories | Tobacco Growing Households | Households Growing crops other than Tobacco | ||

| 1. | Average household size (Nos.) |

5.82 |

4.36 |

||

| 2. | Average land holdings (acres) |

3.84 |

1.60 |

||

| 3. | Average irrigated land (acres) |

0.42 |

0.70 |

||

| 4. | Category of farmers | ||||

| Marginal (%) |

48.25 |

91.67 |

|||

| Small (%) |

34.25 |

5.55 |

|||

| Medium (%) |

13.75 |

2.78 |

|||

| Large (%) |

3.75 |

0.00 |

|||

| 5. | Joint Family (%) |

50.0 |

36.0 |

||

| 6. | Occupation |

Main |

Sub |

Main |

Sub |

| Agriculture (%) |

96.0 |

2.5 |

42.0 |

50.6 |

|

| Agri. Labour (%) |

0.75 |

23.0 |

42.0 |

19.0 |

|

| Salaried (govt /pvt) (%) |

2.00 |

5.0 |

5.5 |

2.8 |

|

| Self owned (%) |

1.75 |

7.5 |

11.0 |

5.5 |

|

| Livestock (%) |

– |

0.5 |

– |

5.5 |

|

| Casual labour (%) |

0.50 |

3.0 |

– |

5.5 |

|

| 7. | Average total annual income (all sources) (Rs.) |

2,39,878 |

54,460 |

||

| 8. | Average annual income (agriculture)(Rs.) |

2,11,000 |

19,997 |

||

| 9. | Share of agricultural income in total (%) |

87.96 |

36.72 |

||

| 10. | Population in working group (15-70) (%) |

74 |

74 |

||

| 11. | Family members engaged in agricultural work (%) |

55.28 |

51.59 |

||

| 12. | Reported child labour (%) |

2.00 |

— |

||

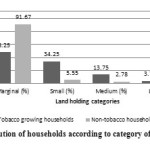

Secondly, the cost of tobacco cultivation is higher as compared to other crops and as such the farmers would benefit from cultivation on larger holdings due to economies of scale. From Table-4 we can see that the average land holding in tobacco growing households is significantly higher than the average size of holdings of non-tobacco growers. None of the non-tobacco growers are large farmers. Even the share of small and medium farmers among non-tobacco growers is less than 10% with majority (92%) being marginal farmers (see fig-1).

|

Figure 1: Distribution of households according to category of land holdings. |

Thirdly, the average size of irrigated land is lower among tobacco growers and it should be noted that tobacco is a rain-fed crop. So ownership or access to irrigation facilities could induce farmers to try other crops. Fourthly, the total average annual income of the households from different sources including agriculture, rental sources, livestock and salaried employment is higher by a significant 3.4 times for tobacco growing households as compared to the total income of non-tobacco households. The agricultural income contributes 88% of the total income for tobacco households, whereas, it is only 37% for non-tobacco households. The share of other income sources is higher for non-tobacco growers indicating their dependence on other activities.

The percentage of household members engaged in agriculture is also higher in tobacco growing households (55.28%) than in non-tobacco households (51.59%). The demand for labour seems to be higher in tobacco growing households as around 2% of children were reported to be involved in agricultural work, whereas none of the non-tobacco households reported child labour.

Cropping Pattern

Tobacco occupies around half of the cropped area followed by ragi (20%) a local staple food, hurali (6.96%), alasandi (6.56%), peas (5.75%) and paddy (5%) for the sample households. The cropping pattern of Mysore and Hassan districts reflect almost similar pattern with respect to percentage of land under different crops. Tobacco, hurali, ragi, alasandi and paddy are the common crops in both the districts and the percentage of land allocated out of the total cropped area is also similar for each crop in two districts. Only in the case of peas there is a variation in cropped area. Peas are grown in 6.81% of the cropped area in Mysore as compared to 1.09% of land in Hassan district. Among non-tobacco farmers 55% have access to irrigation and half of these farmers grow paddy. While 29% of the tobacco growers have irrigated land accounting for 18% of their total owned land 28% of the non-tobacco growers own irrigated land, which accounts for 28% of their total owned land. The major differences between irrigated and non-irrigated land is found in the share of land under tobacco, paddy and hurali. The share of tobacco, hurali and, other food crops like peas and ragi is higher in land owned by non- irrigated farmers as compared to their respective shares in land owned by farmers with irrigated land who are likely to grow paddy also.

Cost of Cultivation

The information on the cost of cultivation including seeds, fertilizers, pesticides, labour, curing, packing/transport and other items was collected for the reference year (previous year of the study i.e., 2009-10 agricultural season) for different crops from tobacco and non-tobacco growers. The results are given in Tables 5 and 6 below. The cost of curing contributes to almost half (44%) of the cost of cultivation in tobacco. Generally in all other crops, payment for labour is a major cost component. Expenditure on fertilizers is the second major component of the cost of cultivation in majority of the crops with an exception to ginger, wherein more than 35% of the cost is on seeds. Among the households growing FCV tobacco with other crops the average cost per acre are higher for cash crops and highest for ginger followed by tobacco, sugarcane, chilly and turmeric. The average total cost of cultivation per acre is lowest for hurali followed by peas and ragi. However we need to look into the cost of cultivation of each crop in comparison to their returns per unit of land cultivated in the reference period.

Economic Returns

Following from the discussion in earlier section, although the average total cost of cultivation per acre was the lowest for hurali it is not a profitable crop. The net returns and returns per rupee of investment are also lowest for hurali indicating that although the costs are lower, it is neither a substitute to tobacco nor a profitable crop due to lower returns.Overall, the net returns per acre were higher for cash crops and highest for ginger followed by tobacco, sugarcane, chilly and turmeric.

Table 5: Crop-Wise Distribution of Costs of Cultivation and Returns for Tobacco Growers (Rs.).

| Sl.No. | Crop | Crop area (acres) | Average cost/acre | Net returns per acre | Net returns per rupee of investment |

| 1. | Tobacco |

1431.22 |

31532 |

18396 |

1.58 |

| 2. | Hurali |

197.47 |

1685 |

385 |

1.23 |

| 3. | Sugar cane |

2.00 |

28000 |

12000 |

1.43 |

| 4. | Peas |

163.03 |

2971 |

1672 |

1.56 |

| 5. | Ragi |

566.71 |

3545 |

1714 |

1.48 |

| 6. | Tadni |

185.97 |

1978 |

1515 |

1.77 |

| 7. | Chilly |

7.50 |

11527 |

11620 |

2.01 |

| 8. | Ginger |

10.00 |

50830 |

24670 |

1.48 |

| 9. | Oil crops |

34.25 |

6417 |

3174 |

1.49 |

| 10. | Jowar |

26.50 |

3841 |

6431 |

2.67 |

| 11. | Paddy |

141.73 |

7037 |

4345 |

1.62 |

| 12. | Plantation |

23.10 |

5922 |

11329 |

2.91 |

| 13. | Others |

48.00 |

5946 |

-956 |

0.84 |

| 14. | Total |

2837.48 |

17873 |

10361 |

1.58 |

Note: There was failure of some crops due to heavy rains in the reference period

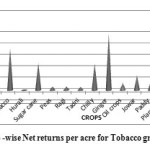

When we compare returns per rupee of investment (Table5), crops like jowar (Rs.2.67), chilly (Rs.2.01), alasandi (Rs.1.77), paddy (Rs.1.62) appear to bring in higher returns for every rupee spent by farmers. Although net returns per rupee of investment is highest for plantations (Rs. 2.91), it would be inappropriate to include these in the list when we are considering feasible or profitable alternatives to tobacco cultivation. Plantations, particularly coconut and areca nut yield returns in the long run and cannot be proposed as an immediate alternative or as short term measure. However, farmers can be motivated to keep aside a part of their land for plantations as the returns for invested money is higher in the long run as compared to other crops because of the low maintenance costs. By doing so, the land under tobacco can also come down.

|

Figure 2: Crop-wise Net returns per acre for Tobacco growers (Rs.). |

Taking into account the reported data on costs and returns it can be assumed that ginger in Karnataka light soil region is a profitable crop. The fact that only 2% of the farmers have cultivated ginger indicates lack of awareness among farmers about the economics of ginger including marketing and suitability of the crop to local soil conditions. Crops other than ginger earn fairly lower net returns per acre as compared to tobacco. Net returns per rupee of investment indicate jowar, chilly, alsandi and paddy to be profitable than tobacco, while ginger, sugarcane and peas bring in returns nearer to that from tobacco. So, farmers from selected regions can be motivated to grow ginger and chilly in addition to mixed cropping of food crops.

It should be noted that even if crops like ginger and chilly can be remunerative, tobacco farmers are not inclined towards cultivation of alternatives because they do not get timely credit, fertilizers, pesticides, seedlings and market facilities, which are available and facilitated by Tobacco Board for FCV tobacco.

Table 6: Crop–Wise Distribution of Costs of Cultivation and Returns (Rs.) for Non-Tobacco Growers.

| Sl.No. | Crop |

Crop area (acres) |

Average cost/acre |

Net returns per acre |

Net returns per rupee of investment |

| 1. | Hurali |

3.525 |

1374.47 |

1831.2 |

2.33 |

| 2. | Peas |

2.05 |

3726.83 |

-1629.27 |

-0.56 |

| 3. | Ragi |

20.55 |

5462.29 |

2673.96 |

1.48 |

| 4. | Tadni |

4.4 |

2153.41 |

846.59 |

1.39 |

| 5. | Ginger |

0.75 |

40533.33 |

26133.34 |

1.64 |

| 6. | Oil crops |

18.45 |

4894.31 |

5197.83 |

2.06 |

| 7. | Jowar |

3.075 |

4006.50 |

11147.97 |

3.78 |

| 8. | Paddy |

15.11 |

6669.09 |

4575.12 |

1.69 |

| 9. | Plantation |

1.0 |

1000.00 |

9000.00 |

10.00 |

| 10. | Others |

3.0 |

7226.67 |

773.33 |

1.11 |

| 11. | Total |

71.91 |

5432.90 |

4060.91 |

1.75 |

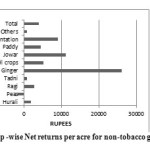

Among non-tobacco growers, the cost of labour constitutes highest component of cost chunk followed by fertilizer and seeds in total cost of cultivation of different crops except ginger wherein the cost of seeds takes away 50% of the costs. Ginger earns highest net returns per acre for non-tobacco growers also (Fig- 3). However, due to high cost of cultivation the net returns per rupee of investment are lower for ginger than returns from other crops. The net returns per acre as well the net returns per rupee of investment are higher for plantation, oil crops. Although ragi a local food crop earns less than the average net returns it constitutes highest share of cropped area (29%) followed by oil crops (26%) and paddy (21%). The cost per unit of cultivation is lower for hurali a local pulse, which also earns comparable net returns per rupee of investment. But, net returns per unit of cultivation for this crop are not so favourable. As said earlier most of the crops suffered loss due to heavy rain during the reference period.

|

Figure 3: Crop-wise Net returns per acre for non-tobacco growers (Rs.). |

Credit Worthiness of Tobacco Vs. Non-Tobacco Farmers

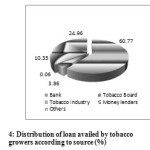

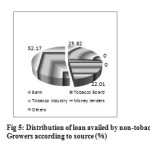

Details of credit availed by tobacco and non-tobacco growers during the reference period indicates the extent of importance given to tobacco cultivation (Figures 4 and 5). While tobacco farmers get 61% of the credit from banks, non-tobacco growers receive only 26% of their credit need from the banks. As a result, the dependence of tobacco growers on money lenders (10.3%) and other private sources like relatives and friends (25%) is lower as compared to non-tobacco growers whose dependence is largely on moneylenders (22%) and other private sources (52%). Taking loan from moneylenders and relatives at higher rate of interest is risky for the farmers as they are likely to fall in to debt trap. Tobacco growers also reported that they had received loans from Tobacco Board for purchase of inputs, fertilizers, etc. But, in real terms Tobacco Board does not give loans to farmers. It providefertilizers and other inputs at subsidized rates. Farmers consider their dues to Tobacco Board (which it deducts directly from the amount received by auction of tobacco) as loan amount. The average interest rates for banks turned out to be 7.8% p.a. while that of money lenders and other private sources is 46.2% and 63.3% p.a. respectively. While the difference in interest rates varied from 1% to 36% for bank loans, the variation in minimum and maximum interest rates were 1% and 80% respectively for private loans.

|

Figure 4: Distribution of loan availed by tobacco growers according to source (%). |

|

Figure 5: Distribution of loan availed by non-tobacco Growers according to source (%). |

We can also say that tobacco cultivation is costlier as 97% of the farmers have availed loan for agriculture and other purposes, whereas 67% of non-tobacco growers have taken loan during the reference period. The average loan borrowed by tobacco growers amounts to Rs. 1,61,009 p.a., while the demand for loan is lesser among non-tobacco growers being on an average Rs. 20,444 per annum. This translates into an average borrowing with outstanding loan of Rs.22697 per acre for tobacco growers and Rs.10235 per acre for non-tobacco growers for the reference period (2009-10). This amount also includes loan taken during earlier years, which is not bifurcated as farmers could not reveal the exact year of assistance. It appears from field data that farmers are totally dependent on loan for carrying out agricultural activities whether it is tobacco or other crops. The own capital investment or recurring expenditure on their own appears to be almost nil. This also reveals the fact that farmers are always under debt trap. The share of loan for domestic purposes, which is generally assumed to be unproductive, is substantially higher among non-tobacco growers.

The distribution of loans according to purposes reveals that tobacco growers have taken loans largely for productive purposes i.e., mainly to meet expenses of agricultural operations accounting to almost 93% of total loan. In comparison non-tobacco growers have availed 59% of the loan for agricultural purposes, while almost 39% is spent on domestic purposes.

This emphasizes the need for streamlining and introducing discipline in disbursement of loan to farmers by restricting new loan in the absence of old loans. This would prevent farmers falling in to debt trap year after year. A better understanding of the credit picture would be possible if the information is collected or available for one agricultural year separately and this study is limited by such information gap. Farmers take the loan in between agricultural season and the repayment spreads over two or three crop seasons. And in between they borrow for next agricultural season. As a result there is always some outstanding amount, which could be very high taking in to account old and new loans. Therefore it is difficult to account for agricultural loans for one separate season or annually.

Livestock Rearing as a Substitute to Tobacco Cultivation?

Among the tobacco growing households around 39% reported livestock rearing (cows, chickens, sheep, goats and buffalo) as one of their activities. Cows and oxen are owned by an equal number of households (29%), while ownership of other livestock is reported only by around 10% of the households.

The average annual income for tobacco growers from the sale of livestock or its products (milk, egg, sheep, goat, calf, etc.) ranges from Rs. 1258 (chicken and egg) to Rs. 11,245 (milk and calf). But, even the highest amount of average annual household income earned from any of the livestock products is less than the average annual income (Rs.65,821) and net returns per acre (18,396) earned from tobacco crop. And the net annual returns per household and per unit of livestock are negative for cow rearing. Net annual returns per unit of livestock are not encouraging for other categories of livestock and for non-tobacco growers’ families also.

None of the households reported livestock as the main occupation. So it may not be appropriate to compare income from subsidiary occupation i.e., livestock rearing in this case with the income from main occupation i.e., agriculture. This is because the amount of investment, labour and time involved in subsidiary occupation would be much lesser than that involved in main occupation (agriculture).The observation at field level and information collected from the households indicate that livestock rearing has been one of the household activities rather than a household occupation.

Tobacco Cultivation-Farmers’ Perceptions

Ninety five percent of the farmers know that the government is looking for alternatives to reduce tobacco cultivation. They have been sometimes told by the Tobacco Board about phasing out of tobacco over the years. We asked farmers whether they would back the measures of the government in case it plans to reduce tobacco. Sixty three percent responded positively saying that they are willing to shift. Higher costs of cultivation, health problems, news about government’s plans to reduce tobacco and labour problems were the four main reasons that the farmers felt could motivate them to shift. There is also a cloud of uncertainty among tobacco growers with regard to future of tobacco cultivation.

However, not all farmers are willing to shift from tobacco. Thirty six percent said that they would not agree with government’s intention to reduce tobacco. High returns, non-availability of alternatives and availability of credit were the three reasons for their decision for not supporting tobacco reduction. We also tried to know from farmers whether they could suggest some feasible alternative crops that could be promoted in the region. Sixteen percent did not respond at all. Among eighty four percent who responded, majority (19%) felt that ginger could be one of the best alternatives. Other main alternatives indicated by farmers in order of ranking are ragi (17%), mulberry (10%), paddy (8%), sugarcane (8%) and oil crops (7%).

Field data revealed that only 1-2% of the cultivators in each of the village surveyed in this study are not cultivating tobacco of them 33% were growing FCV tobacco earlier and gave up due to non-availability of labour and hardships associated with cultivation. The remaining 67% who have never grown tobacco are not happy with the cultivation of other crops also. This indicates the absence of feasible substitutes for tobacco crop and also the status of Indian agriculture.

We also tried to find out whether tobacco farmers can identify any subsidiary occupations that they think are feasible to tobacco region, which would supplement agricultural income from other crops if tobacco is given up. Income from such activities would act as backup or help farmers to sustain the risks of loss in alternative crops in case they shift from tobacco to other crops. All the farmers responded to this question. But, 70% felt that there cannot be any suitable alternative livelihood activity that can supplement agricultural income from alternative crops to the extent of the earnings farmers receive from tobacco.

Of those 30% who suggested alternative livelihood 7% voted for sericulture (not just the cultivation of mulberry leaf, but rearing of silk worms for production of raw silk), 6% for poultry, 7% for dairy, 4% for sheep rearing and 3% each for small business and brick making.

Given the current scenario, we were interested in knowing the steps ahead that could motivate farmers to cultivate crops other than tobacco. We asked them to suggest any measure that could help government to reduce tobacco cultivation without affecting the interests of the farmers. All the tobacco growers responded to this question. Provision of irrigation was suggested by majority (41%) as one of the measures to promote crops like paddy, mulberry, sugarcane, vegetables and ginger.

Conclusion

How to promote alternative crops/livelihoods to tobacco? Apart from technical factors and suitability of soil conditions, the responses in this regard should come from farmers such as, what to grow, what assistance they need to shift from tobacco to other crops or to other livelihood, is it marketing, credit, infrastructure, agricultural inputs, irrigation, export promotion, and training.

The major constraints to diversification as indicated by the review of studies are; lack of policy framework and strategy for implementation, poor dissemination of technology, lack of economic information on potential crops and activities, bias towards research on tobacco crop and extension facilities, limited experiments on crop substitution and, lack of understanding of farmers’ perceptions on crop diversification.

It is clear both from review of literature and this empirical study that farmers are interested or willing to shift from tobacco. But, this willingness is conditional or is responsive to fulfillment of demands. The review of literature also indicates that although there are alternatives that are being tried out, they are backed by huge investment of infrastructure. Studies in Tanzania, Bangladesh and India reveal that institutional support is the main factor inducing continuation of tobacco cultivation.

Some of the alternative crops viz. sugarcane, cotton, etc., suggested by research studies require irrigation. Tobacco is preferred due to its drought resistance nature and suitability for growing under rain-fed conditions. Other problems associated with substitution by other crops include the capital invested in specialized facilities created for tobacco processing, which cannot be used for other crops for e.g. barn, the difficulties of finding substitute crops for rain-fed areas, and the dependency of millions of people on bidi rolling and tendu leaf collection. These issues are crucial for policy decisions. Moreover, with an assured market and prompt payment of sale proceeds through the Tobacco Board, it will be difficult to replace FCV tobacco as a crop unless such facilities are extended to other crops. Based on net returns per unit of cultivation this study indicates the possibilities of promoting ginger, chilly, sugarcane and plantation crops as alternatives to tobacco.

From the sample covered in this study we could not find any instances of other remunerative livelihoods taken up by tobacco growers and non-tobacco growers on large scale or as major occupation. The earnings from livestock rearing, which is one of the subsidiary occupations reported by farmers is at subsistence level and cannot be compared with earnings from tobacco cultivation. At the same time majority of the tobacco growers could not suggest any profitable alternative livelihoods in tobacco growing region.

The shifting from a crop that has been grown for several years cannot happen naturally, it has to be induced by exogenous factors like input supply, credit, infrastructure, marketing, etc. Since tobacco crop falls under different ministries, departments and research centres, coordinated effort is necessary to reduce tobacco cultivation phase by phase in the country. Series of talks may be held with the scientists of agricultural universities, Central Tobacco Research Station(CTRI), Indian Council of Agricultural Research (ICAR), Tobacco Board, Regional Research Centres, Tobacco Growers’ Associations, state agricultural departments, etc. to promote alternative crops and livelihoods through provision of incentives both in cash and kind to compensate for giving up assured returns or towards expected loss from other crops and activities that farmers are likely to adopt.

As the findings of the study indicate the availability of larger chunk of bank credit to a larger section of tobacco growers as compared to non-tobacco growers, all the commercial and co-operative banks should be instructed to stop this discrimination against non-growers and lend them credit on par with tobacco at least in tobacco growing region.

Farmers experienced crop failure during the reference period i.e., 2009-10 when the survey was actually carried out and, received negative returns for food crops like ragi, hurali, alsandi, etc. Therefore, it would be inappropriate to conclude or generalize that tobacco is highly remunerative based on the result of this survey. However, such situations indicate that non-tobacco farmers are vulnerable to the risks of natural factors, whereas tobacco appears to be a rigid crop. Therefore, insurance to crops other than tobacco should be an integral part of promoting alternative crops.

FCV Tobacco is a region specific crop cultivated in limited area in states viz. Andhra Pradesh and Karnataka, which account for more than 90% of total tobacco cultivation. Area under FCV tobacco is only 348.1 thousand ha (CMIE, 2010) accounting for 35% of tobacco crop area in the country and around 0.1% of net sown area in the country. Around one lakh farmers grow FCV tobacco in Karnataka and Andhra Pradesh including a few from Orissa and Maharashtra. So it may not be difficult for the government to intervene to rehabilitate these farmers by facilitating cash and kind benefits to take up alternative crops or livelihoods. Compensation may be made towards barns established by farmers for curing tobacco. FCV tobacco is a crop regulated by the rules of the Tobacco Board, Government of India. This makes it easy for intervention in terms of any policy changes and to introduce reforms or impose restrictions on production in the interest of the farmers, society and environment.

Directorate of Tobacco Development (2006), Status Paper on Tobacco Ministry of Agriculture, Government of India, Chennai.

Acknowledgements

This study was carried out with the financial support received from Indian Council of Social Science Research (ICSSR), New Delhi. Thanks are due to Tobacco Board, Mysore, Central Tobacco Research Institute (CTRI), Hunsur and tobacco farming households for providing the necessary information for completing this study. The help received from the field investigators in completing the household survey and, the logistics support received from the staff members of CMDR, Dharwad is sincerely acknowledged.

- Abdallah, J. M., Mbilinyi B., Ngaga Y. N. and Ok’ting’ati A., Impact of flue-cured Virginia on Miombo woodland: A case of small-scale flue-cured Virginia production in Iringa region, Tanzania, Discovery and Innovation, 19(1-2), 92-106 (2007).

CrossRef - Akhter Farida “Tobacco Cultivation and its Impact on Food Production in Bangladesh” UBINIG, Bangladesh (2011) [available at www.fairtradetobacco.org accessed on 18.10.2011].

- Altman D.G., A view from the fields, North Carolina Med J,56, 37–81 (1995).

- Bhat B.N., A.R.Hundekar, R.S.Khot and B.A.Yandagoudar, Bidi Tobacco Research in North Karnataka, University of Agricultural Sciences, Dharwad, 22 (1998).

- CBECDDM Report No. 17 of 2013 (Indirect Taxes-Central Excise and Service Tax [available at saiindia.gov.in/english/home/our_products/…/chap_1.pdf] (2013).

- Central Tobacco Research Institute ‘Tobacco in Indian Economy’ [available at http://www.ctri.org.in/for_tobacco Economy.php, accessed on 17-6-2015]

- Centre for Monitoring Indian Economy, ‘Agriculture’, CMIE Pvt. Ltd., Mumbai (2010).

- Dinesh Kumar M., Channa Naik, S. Sridhara, T.S.Vagheesh, G.K.Girijesh and S. Rangaiah, “Investigation on economically viable alternative cropping systems for FCV tobacco (Nicotianatabacum) in Karnataka”, Karnataka Journal of Agricultural Sciences, 23 (5),689-692(2010)..

- Mataya Charles S. and Ernest W. Tsonga, Economic Aspects of Development of Agricultural Alternatives To Tobacco Production And Export Marketing In Malawi United Nations Conference on Trade & Development, United Nations Publications(2002).

- Geist, H. J. Global Assessment of deforestation related to tobacco farming. Tobacco Control, Vol. 8:18-28 (1999).

CrossRef - Geist Helmut, Kang-tsung Chang,Virginia Etges and Jumanne Abdallah, Tobacco growers at the crossroads: Towards a comparison of diversification and ecosystem impacts Land Use Policy, 26 (4),1066-79 (2009).

CrossRef - Kibwage J.K., G. W. Netondo, A. J. Odondo, B. O. Oindo, G. M. Momanyi and F. Jinhe, Growth performance of bamboo in tobacco-growing regions in South Nyanza, Kenya, African Journal of Agricultural Research, 3 (10),716-724(2008).

- Ministry of Health and Family Welfare, Report of the Expert Committee on the Economics of Tobacco Use, Government of India, New Delhi, 83(2011).

- Panchamukhi P.R., Sailabala Debi, V.B.Annigeri and Nayanatara S.N., Economics of Shifting from Tobacco, Unpublished report of the study sponsored by IDRC, Canada, Centre for Multi Disciplinary Development Research, Dharwad, 63-103 (2000).

- Krishna Rao E.and G. Nancharaiah,“Alternative to Tobacco Crop Cultivation in Rabi Season:A Cost Benefit Analysis”, Agricultural Situation in India,69 (2),67-78(2012).

- Sathyapriya V.S. and Govinda Raju, Economic Viability of Alternative Crops to Tobacco, Institute for Social and Economic Change, Bangalore, (1990).

- Tobacco Board (2010-11, 2011-12) Annual Reports, Tobacco Board, Ministry of Commerce, Government of India, Guntur (2012).

- Tobacco Board (2012-13) Annual Report, Tobacco Board, Ministry of Commerce, Government of India, Guntur (2013).

- World Health Organization, Study group on economically sustainable alternatives to tobacco growing (in relation to Articles 17 and 18 of the Convention) (provisional agenda item 4.8, FCTC/COP/1/11), available online at <http://www.who.int/gb/fctc/PDF/cop3/FCTC_COP3_11-en.pdf>, accessed on 18 October 2011.

- www.statista.com Tobacco Industry – Statistics & Facts | Statista [available at www.statista.com › Industries › Agriculture › Farming accessed on 28-3-2015].